L. Amedee Darga, Managing Director, StraConsult

The African Continental Free Trade Area (AfCFTA) ambitions to develop a single African market for goods and services. Amedee Darga reviews some of the key factors that will be needed to transform the AfCFTA ambition into a successful reality. AfCFTA is an opportunity for Mauritius to reap greater benefits in terms of exports and investments through increased intra-African trade. Yet, for this, Mauritius will need to build more supply capacity.

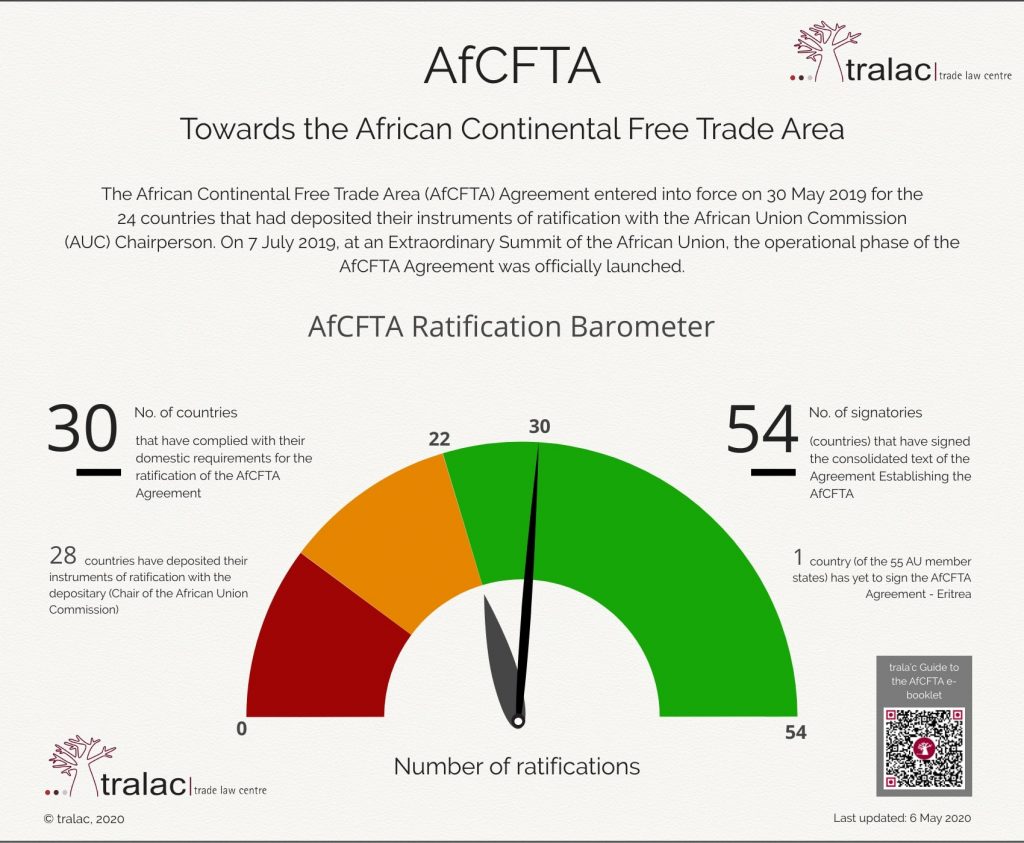

Fifty-four out of 55 African countries have signed to launch an African Continental Free Trade Area (AfCFTA) that will involve a market of over 1.0 billion consumers. As the AfCFTA unfolds, it is not a matter of whether it should be, but of how to make it growingly real and effective. Of the 54 signatories, 30 have already ratified and deposited the required instruments. This shows a very high level of political support for the AfCFTA. However, as with all such great ambition, it will be a long road before we have a quasi-single African market. After all, even for Europe which started with The Single European Act in 1986, the single market is still not completed as such.

The stated objectives of the AfCFTA are to boost intra-African trade and to create a single market for goods and services. The inclusion of services is a major step here. Long term, the agreement is looking at the establishment of a Continental Customs Union. In March 2018 the texts of the Protocols on Trade in Goods, Trade in Services and Dispute Settlement were adopted at an Extraordinary Summit held in Kigali, Rwanda. There will now be a succession of rounds of negotiations to define agreed tariffs reductions, rules of origin and specific commitments for the five priority services sectors. The five sectors being: Business services, Communication Services, Financial Services, Tourism and Travel and Transport.

Attempts and Achievement till now.

The determination to boost up intra-African trade is not new, it has been underway on a regional basis for the last forty years in certain regions. The share of intra-African exports as a percentage of total African exports has increased from about 10 per cent in 1995 to around 17 per cent in 2017, but it remains low compared to levels in Europe (69 per cent), Asia (59 per cent), and North America (31 per cent).

However, if we look at the share of intra-regional economic community trade in total trade in Africa, in 2016, we will note deeper levels of integration for example in SADC (84.9 per cent), followed by COMESA (59.5 per cent), CEN–SAD (58.4 per cent) and ECOWAS (56.7 per cent).

Furthermore, it is also most interesting to note that:

The 10 leading intra-African exportersin 2015–2017 were Eswatini (70.6%), Namibia (52.9%), Zimbabwe (51.6%), Uganda (51.4%), Togo (51.1%), Senegal (45.6%), Djibouti (41.9%), Lesotho (39.9%), Kenya (39.3%) and Malawi (38.3%).

Here again, those figures however may imply some realities which are not explicit unless they are disaggregated. For example, are all exports of Zimbabwe truly intra-African of simply exports to South Africa for re-export to the outside world? Does Senegal really export 45.6% of Senegalese produced goods to its region or is it a port of transit for goods from external countries on re-export to other West African countries in its region?

The Key Success Factors

There are key factors that will determine the speed at which the grand design will progress and the rate of success will be achieved.

- How the flying geese will behave.

The flying geese paradigm is now well established since coined in the thirties and gained popularity sixties with Kaname Akamatsu with regards to the development of South-East Asia. It simply refers to the flying geese inverse “V” formation and means that not all countries in a region manage to develop at the same speed at reach the same level, but as one emerges faster, it has the power to create a favourable draft that pulls others faster if the others do what it takes to move in the draft.

Of the 54 countries of the African continent, there are some economically muscular players like Egypt, Morocco, Nigeria, Kenya and South Africa. Interestingly, these five countries are in the five regions of the continent. They have the potential to be the lead geese of the flying geese formation in their respective regions even if right now, a country like South Africa is somewhat of a limping goose. However, they could also be a drag if they try to put spanners in the wheel on some of the key success factors by imposing Rules of Origin, Non-Tariff Barriers or technical barriers.

- Supply Side Capacity

This is a most important success factor. Africa is handicapped by a severe supply-side capacity and supply chain constraint. You cannot trade more if you don’t have much to sell. A large number of African countries are heavy commodity producers whose exports out of Africa are not transformed or value added. One striking example is cotton. Africa exports close to 1.6 million tons of cotton but imports fabrics and garments massively from the rest of the world. This commodity is a case where the potential for regional supply chain and value addition has not happened partly because of lack of investment and partly because of narrow nationalistic perspective. Supply-side capacity requires industrialisation. Industrialisation requires conducive conditions for doing business, from infrastructure capacity to fiscal policy. One country, Ethiopia has well understood this and has seen its industrial sector, its exports and its GDP grow by an average of 9% per annum in the last ten years.

- A Maze of Preferential Access.

African countries, mainly the Least Developed Countries have signed in other preferential trade agreements with other non-African partners, mainly the European Union. The question is how will the preferential market access between African countries be more preferential than the market access granted under such other agreements. For sure African countries have some potential competitive advantages such as labour cost and physical proximity to markets. provided transport infrastructure is to the required level. Today it costs more to transport goods from Dar es Salaam to Lusaka than from China to Dar es Salaam! Capacity and cost of electricity and water is another success factor to be addressed for a number of countries. With electricity at US$ 0.09 per Kwh and a relatively low-cost productive labour, Ethiopia has attracted Chinese, British and Turkish investments despite being a landlocked country.

- Non-Tariff Barriers

Giving preferential access through lower tariff should not be nullified by countries imposing Non-Trade Barriers (NTBs). NTBs refer to restrictions that result from norms and standards, or specific market requirements that make importation or exportation of products difficult and costly. Some countries under the Common Market for Eastern and Southern Africa (COMESA) and Southern African Development Community (SADC) are well known to have abusive use of NTBs when trading with other African countries.

- Fiscal constraint

The fiscal policy and fiscal flexibility of a country can have an impact on its willingness to open to preferential tariffs. Many African States rely heavily on corporate taxes and custom taxes to finance state expenditure. Custom tariff represents for many countries between 20 to 30% of state revenue. Countries with a narrow private sector base, low employment levels and high imports are often caught in a vicious circle where they cannot earn revenue from consumption taxes and corporate tax. These countries tend to be the slowest at implementing preferential tariffs for neighbour countries. It is in recognition of this fiscal constraint factor that the region’s largest trade bank, Afreximbank has unveiled a $1bn financing facility. It will enable countries to adjust in an orderly manner to sudden tariff revenue losses as a result of the implementation of the AfCFTA Agreement.

- Rules of origin

This is a fundamental criterion needed to determine the nationality of a product and is in all trade negotiations a ferociously fought factor. This could make, break or put a brake on the progress of the African Continental Free Trade Area (AfCFTA) that entered into force in May. The rules could be a game-changer for the continent if they are simple, flexible, transparent, business-friendly and predictable.

Those regions that will have in place some of the above listed key success factors, and those countries that will in the same stride create conducive business environment will become extremely attractive for investment in their productive sectors, hence boosting their supply-side capacity. As it stands now, East Africa clearly has the stronger conditions to move faster in the game and offer preferential market access to a population of about 250 million people.

The Benefit for Mauritius

Mauritius is reaping some exports and investment benefits from its relative integration into the region, but the lack of coherence in policy, focus and action means the country is benefitting much less than its full potential.

In 2018, Mauritius Intra-Africa exports accounted for 23% of Mauritius’ total exports and imports for 13% of total imports.

However, it is to be noted that Mauritius mainly exports clothing and fabrics to the rest of Africa. Of the top 10 intra-Africa export products five products are items of clothing or fabric accounting for 30% of Mauritius’ intra-Africa exports for 2018.

While the specific provisions of the AfCFTA are negotiated (and that could be arduous), Mauritius can already benefit more from its membership in its two existing preferential trade areas, the COMESA and SADC, notwithstanding their limitations. The recent 2020 – 2021 budget of the government has announced one measure that can boost Mauritian exports from the already existing supply capacity to the region. The plan to set up Mauritius Export Warehouse in Tanzania and Mozambique will definitely support a number of Domestic Oriented Industry. Some are already gearing for Tanzania which is a more immediately obvious market than Mozambique.

However, the attractiveness of the regional market and preferential access already available under COMESA and SADC commands that Mauritius attracts investment to rapidly build more supply capacity. A few clear lines of potential are:

- Attracting investment in the Freeport for the manufacturing of consumer and intermediate goods.

- Supporting investment in the circular economy for the production of reconditioned household appliances. The latter will see increased demand as the middle-class consumption grow in many of the African countries.

- Supporting investment in the sourcing of primary products and commodities for transformation and value addition to Africa and the rest of the world.

There are some exports of services from Mauritius to Africa but data on the value and target markets are not readily available. Mauritius has good potential to export a range of services in the context of the priority services lines set by the AfCFTA, namely Business services, Financial Services, Tourism and travel. Our trade negotiators should fight all the way during negotiations to ensure that the highway is opened for the benefit of Mauritius.

Notwithstanding its structural dysfunctions, Africa has seen its economies on a growth path during the last fifteen years. The AfCFTA does not immediately guarantee trade – but it does chart a road to travel for increased Intra African trade opportunities. Many countries will be slow movers in opening up, but on a variable geometry approach to implementation, some countries will move faster. Mauritius has the capacity and should gear up to be an early mover to pick up all the fruits it can and set its nest on selected target markets.

Charles Telfair Centre is an independent nonpartisan not for profit organisation and does not take specific positions. All views, positions, and conclusions expressed in our publications are solely those of the author(s).