Ali Mansoor, Chairman of the Regional Multidisciplinary Centre of Excellence (RMCE).

As Mauritius battles with the economic impact of the current pandemic, its aspiration to graduate to an advanced economy status will take more than an increase in its Gross National Income per capita. In this article, Ali Mansoor reminds us what an advanced economy classification entails. He highlights that advanced economy graduates such as Singapore possessed key enabling factors. Mauritius will need to pay attention to these enablers to succeed in its aspirations.

Context and background [1]

With a GNI per capita reaching US$ 12,740 in 2019, on July, 1 of this year the World Bank reclassified Mauritius as a high-income economy. While this is a symbolic accomplishment, it does not necessarily imply a sustainable achievement for Mauritius. The current crisis will most probably shift Mauritius back to upper-middle-income status by 2021. A more meaningful achievement for Mauritius would be to graduate to the International Monetary Fund (IMF) advanced economy status.

An advanced economy is a term used by the IMF to describe the most developed countries in the world. The IMF uses three main criteria aggregated over several years to capture the sustainability of the status: (1) per capita income level, (2) export diversification, and (3) degree of integration into the global financial system. Advanced economies are also countries that typically have a high Human Development Index scores and good institutions. Hence, countries classified as high-income countries by the World Bank will not automatically be classified as advanced economies by the IMF. The World Bank considers as high-income countries any country that has a gross national income per capita of US$12,535 and above. The IMF’s advanced country classification, on the other hand, considers whether the three criteria listed above are sustained over time.

Mauritius is poised to become an advanced economy …. if it can demarcate itself from the many countries that fail to exit the Middle Income Country Trap

Graduating to an advanced economy status has proved hard relative to moving from low income to emerging economy status. Since 1960, only 16 countries have achieved advanced economy status [2].

So what are the key differences between the emerging economies that graduate to advanced economy status and those who have not?

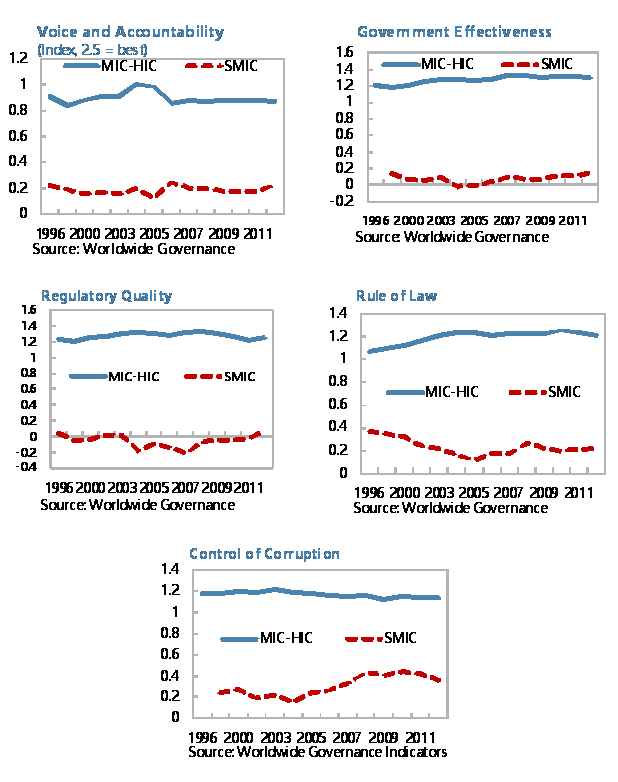

Governance

As indicated in the above charts, the main differences relate to governance. Graduates develop strong institutions that make it harder for narrow interests to capture the state apparatus. A professional and competent merit-based civil service underpins these arrangements.

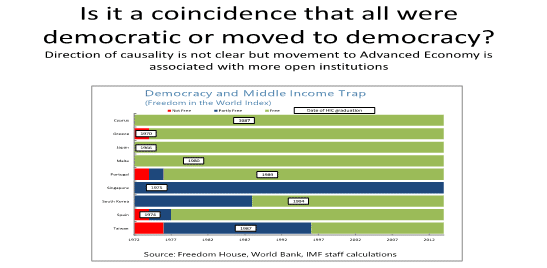

Open Societies

Additionally, open societies seem to help. All graduates either were democratic or moved to democracy.

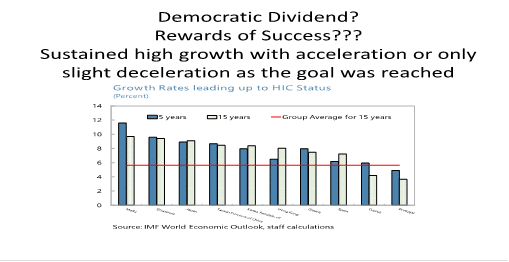

More striking, countries that made the transition were generally able to accelerate growth as they crossed the income threshold, overcoming the effects of an ever-larger base. This may be because they were continually improving institutions and governance as they moved forward.

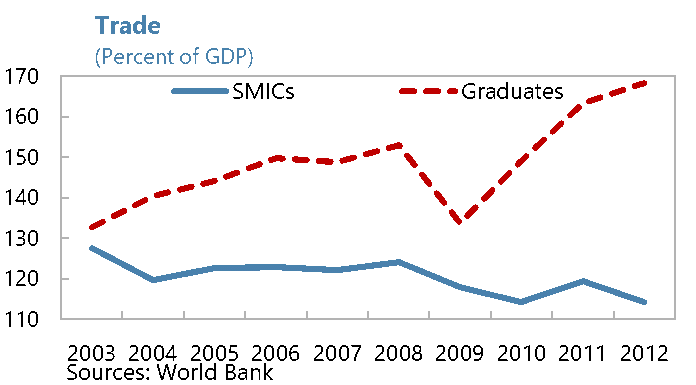

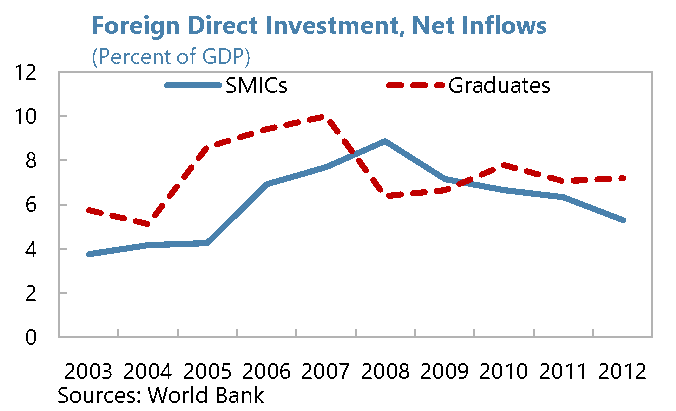

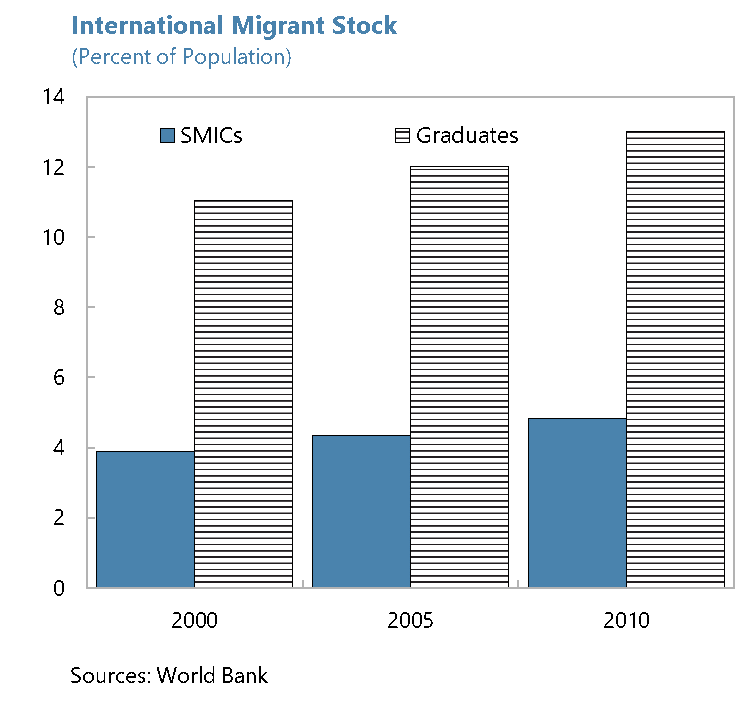

Integration into the global economy

Openness and integration into the global economy are key. Successful transition to advanced economy status is associated not only with relatively free trade and facilitation of Foreign Direct Investment but also openness to migration.

Special Factors

Special factors also played a role in some cases:

- A permanent sense of urgency in view of recovery from a major shock or potential crisis often linked to security considerations as was the case in Cyprus, Czech Republic, Estonia, Hong Kong, Japan, Latvia, Singapore, Slovak Republic, Slovenia, South Korea and Taiwan;

- A clear road map for reforms and economic policies coming from regional clubs such as the EU as was the case for the graduates who joined the EU;

- The presence of a champion for policy reform as was the case in Singapore with Prime Minister Lee Kuan Yew, South Korea with President Park and Taiwan with Chiang Kai-Shek.

Did Mauritius lose its opportunity in the early 90s?

From Independence through the late 1980s Mauritius had many of the characteristics of the successful graduates. This included champions of policy reform in its first two Prime Ministers, a sense of urgency well described by Professors Meade and Titmus [3], and large scale emigration around independence. Moreover, not only were new institutions built, but their operations were merit-based rather than driven by patronage. This included global recruiting for talent, inter alia, in the Central Bank, the Development Bank, the State Bank of Mauritius and the Export Processing Zone Development Authority. The country also boasted a relatively strong and competent civil service inherited from the British colonial administration. It mixed some elements of patronage with an emphasis on delivery of results. This was especially true in key Ministries such as Finance, Planning, Tourism and Industry.

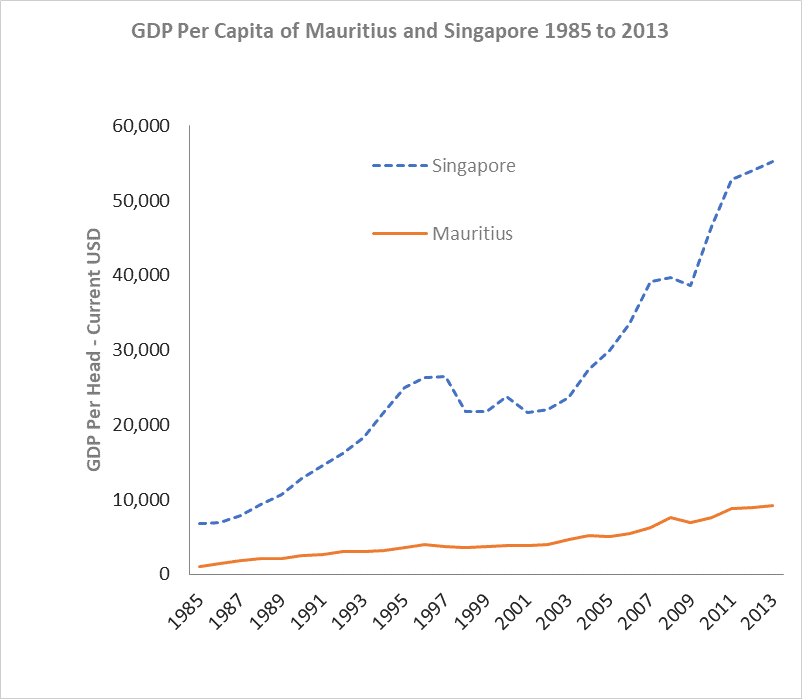

As a result, in the eighties, our growth was similar to that of Singapore. However, from the ’90s whilst our growth continued on trend, Singapore experienced an acceleration of growth through the end of the twentieth century.

The main differences may be that after reaching full employment Mauritius made no major efforts to keep improving its economic performance. There were no transformative policy initiatives until 2006 when Mauritius introduced major reforms to build “a new, open and competitive service platform that [was] fully integrated into the global economy”. The 2006 reforms were less about achieving rapid economic growth and more a response to the triple shocks of loss of textile and sugar preferences and high oil prices. Meanwhile, Singapore was focused on continued rapid growth. Inter alia, this meant allowing migration to overcome the limits of a small population and continued improvement of institutions to attract the FDI needed to support its continued transformation. As reviewed in our book [see note 1], Singapore continued on its growth path thanks to the following key policies:

- it integrated into the global labour market: its population rose from 2.4 million in 1980 to 5.4 million in 2013 of whom about 40 per cent were foreign-born. Mauritius kept its labour market much more closed with a population growing from about 1 million to only 1.3 million over the same period and the percentage of foreign-born representing less than 4 per cent of the population;

- it continued to improve its institutions including importing talent;

- it moved earlier, faster and more aggressively to liberalise international trade.;

- it opened its skies: Changi airport was the strategic asset and not Air Singapore;

- it integrated planning and budgeting in policy making;

- it implemented evidence-based policy making including importing best international practice; and

- it limited patronage and rent-seeking by linking pay to performance and actively combating corruption.

How to make up for the lost period since the 1990’s, accelerate growth and rapidly join the Advanced Economies

Notwithstanding Mauritius’ failure to keep up with the best performers since the 1990s, the country has many assets to build upon to make up for lost time. Mauritius is characterised by:

- A good reputation in Africa with strong international ratings;

- Relatively good Health indicators;

- Effective social policies even though inefficient;

- Scope to import labour if required: it has 4 times the landmass of Singapore and one-quarter of its population and has plentiful of water (yet not always efficiently managed) [5];

- Foreign trade that is largely liberalised;

- An absence of significant internal or external security concerns;

- Ease of mobilising financial capital thanks to its investment-grade rating [6];

- The advantage of being sea locked which provides access to global value chains at low cost;

- A diversified and resilient economic base even though much more needs to be done;

- A clear Africa strategy although a more sustained focus on implementation may be required;

- A solid institutional structure to build on, although governance, transparency and focus on efficiency need to be strengthened

Yet, Mauritius still faces economic and institutional constraints that need to be tackled if it aspires to join the advanced economies camp:

- A weak education system incompatible with the 21st-century information age;

- Poor labour market policies including migration;

- Insufficient innovation reflecting the emphasis on rote learning to pass exams instead of creativity in the school curriculum;

- Lack of attention to the Macroeconomic Trilemma, particularly in the wake of an expanded role for the Central Bank: we need to choose 2 out of 3 between Open Capital Account, Independent Monetary Policy and Floating exchange rate;

- Continually weakening institutions with patronage increasingly overriding competence;

- Lack of planning integrated into budget [7];

- Lack of emphasis on performance;

- Need for systems to move to the frontier of public service delivery; and

- More efficient pathways for learning in key institutions.

The way forward

COVID, the EU Blacklist and the CEB procurement scandal all highlight the need to change and may also give us the push needed to go from the complacency that settled in from the 90’s to find again the resolve that propelled us from low-income basket case to successful middle-income country in the first generation after independence.

All countries can live with some degree of patronage if limited to the less important institutions and can also accept some modest rent-seeking if it does not crowd out outsiders with good ideas and initiative. However, key institutions need to be run on the basis of performance rather than by those loyal to the Government of the day. Where necessary, global talent should be sought.

Strong institutions in key areas will limit rent-seeking by narrow interests that gain control of the State apparatus and facilitate the other required reforms in education, labour markets, planning, housing, agriculture and industry.

Our DNA is based on overcoming challenges by working together. The current crises could be the catalyst required to propel us back onto the path for rapid graduation to the exclusive Advanced Economy club.

Charles Telfair Centre is an independent nonpartisan not for profit organisation and does not take specific positions. All views, positions, and conclusions expressed in our publications are solely those of the author(s).

[1] The charts and content come from the IMF book Africa on the Move: Unlocking the Potential of Small Middle-Income States which the author of this article co-edited whilst at the IMF.

[2]These are: Japan, 1966; Greece, 1970; Spain, 1974; Singapore, 1975; Hong Kong SAR, 1975; Malta, 1980 Taiwan, 1987; Cyprus, 1987; Portugal, 1989; South Korea, 1994; Slovenia, 1995 Slovak Republic, 2003; Czech Republic, 2003; Estonia, 2009; Latvia, 2011.

[3] See The Economic and Social Structure of Mauritius. by J. E. Meade; Social Policies and Population Growth in Mauritius. by R. M. Titmuss, B. Abel-Smith, T. Lynes

[5] Plentiful water has supported poor governance in the Central Water Authority resulting in the island not having 24/7 water supply as should be expected.

[6] Blacklisting by the EU will undermine this asset. Getting off the blacklist will require improvements in Governance, a key enabler to Advanced Economy status.

[7] Linking Performance Budgeting, Performance Management and long term planning within the Ministry of Finance with support from the Ministry of Civil Service may be a good way forward.