Paul Baker, Founder and Chairman of International Economics Consulting Group

Ria Roy, Economist at International Economics Consulting (Mauritius)

Ibrahim Malleck, Managing Partner at Ebonia Capital Ltd, Mauritius

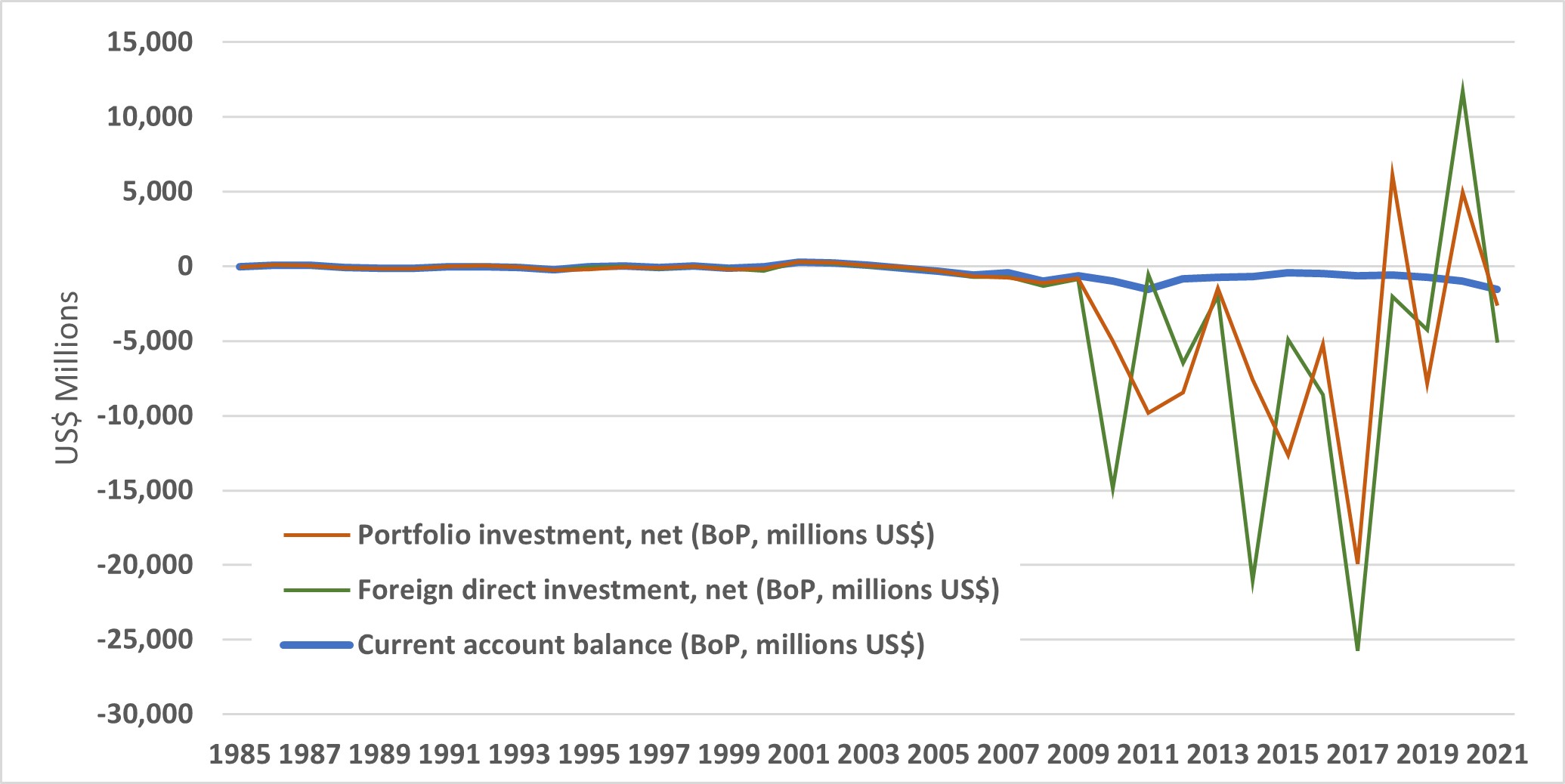

Mauritius has been running current account deficits consistently since 2004, which have been growing in recent years. This results from a savings-investment gap that is not only structural but also pulling down investments due to the low savings rate. While capital inflows have partially offset the accumulation of deficits, most of the Foreign Direct Investment has not been in productive sectors, and the remaining portfolio investment flows are highly volatile. In this article we briefly explore the structural bottlenecks such as import dependency, high debt levels and low savings rate leading to the country’s current account deficit. Despite healthy international reserves, Mauritius has reached debt servicing levels far higher than other middle-income countries. Meanwhile, the structural deficit in the current account is becoming unsustainable in the medium-term horizon.

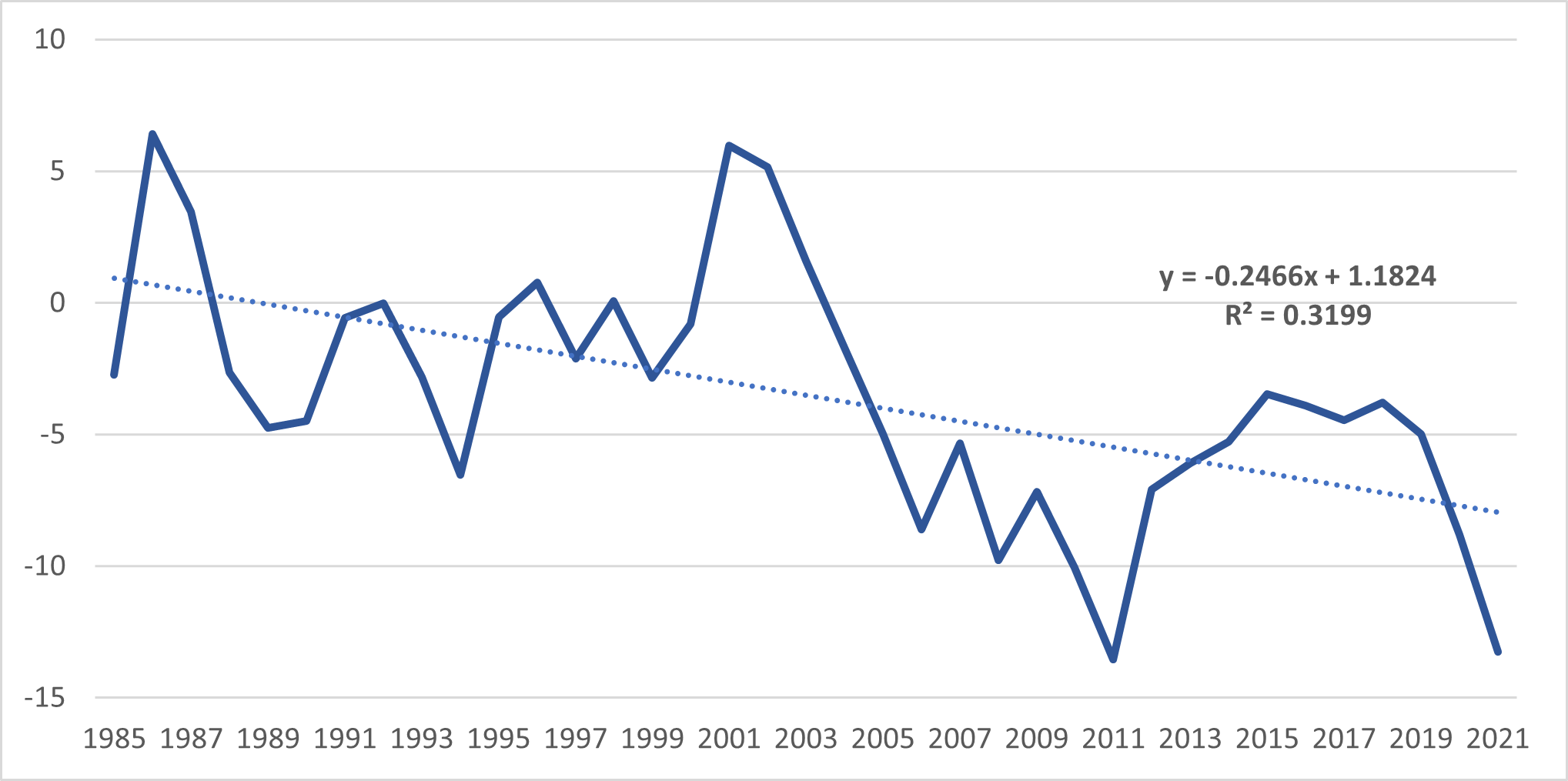

Despite enjoying relatively high economic growth and prosperity levels, Mauritius has experienced persistent current account deficits in recent years. A current account deficit occurs when a country imports more goods and services (and a few other marginal items) than it exports, leading to a net outflow of foreign currency. Most significantly, the trend has been that the current account deficit increases by 0.25% of GDP on average every year since 1985. As of quarter 3 of 2022, the external current account deficit has been estimated at about USD 399 million, almost a 30% increase from a deficit of USD 314 million in the same quarter of the previous year. There are three main structural reasons behind Mauritius’ current account deficit, namely the country’s import dependency, high debt levels and the declining savings rate. All these have implications for the economy.

Structural bottlenecks

One of the main reasons behind Mauritius’ current account deficit is the country’s high dependency on the imports of goods. Mauritius has a relatively small domestic market and a highly developed tourism industry, leading to significant demand for imported goods for consumption. The country also imports many intermediate goods for its manufacturing sector. More importantly, Mauritius has experienced endemic levels of savings, which has led to a net dependence on investment from overseas. This reliance on foreign borrowing to finance the appetite of Mauritius (public and private sector) has increased the country’s external debt and contributed to its vulnerability to economic shocks.

Figure 1: Mauritius Current Account Balance (% of GDP)

The country’s high level of debt is another reason for the current account deficit. Mauritius has a relatively high level of government debt, which has been increasing in recent years. In the second quarter of 2022, Mauritius’ public sector debt stood at MUR 385 billion, which has been steadily increasing, resulting in MUR 410 billion debt at the end of 2022. Historically, the share of foreign denominated debt was under 20% of the national debt stock with long maturities. While the share of external debt stood at 17% of the total debt stock in 2020, this has increased to 26% in 2021 and 24% in 2022 leading to a rise in the use of international reserves for current and future debt repayment (servicing). The recent use of quasi fiscal operations through the establishment of Special Purpose Vehicles (SPVs) [1] has made it more difficult to measure the full extent of Mauritius’s exposure to foreign debt.

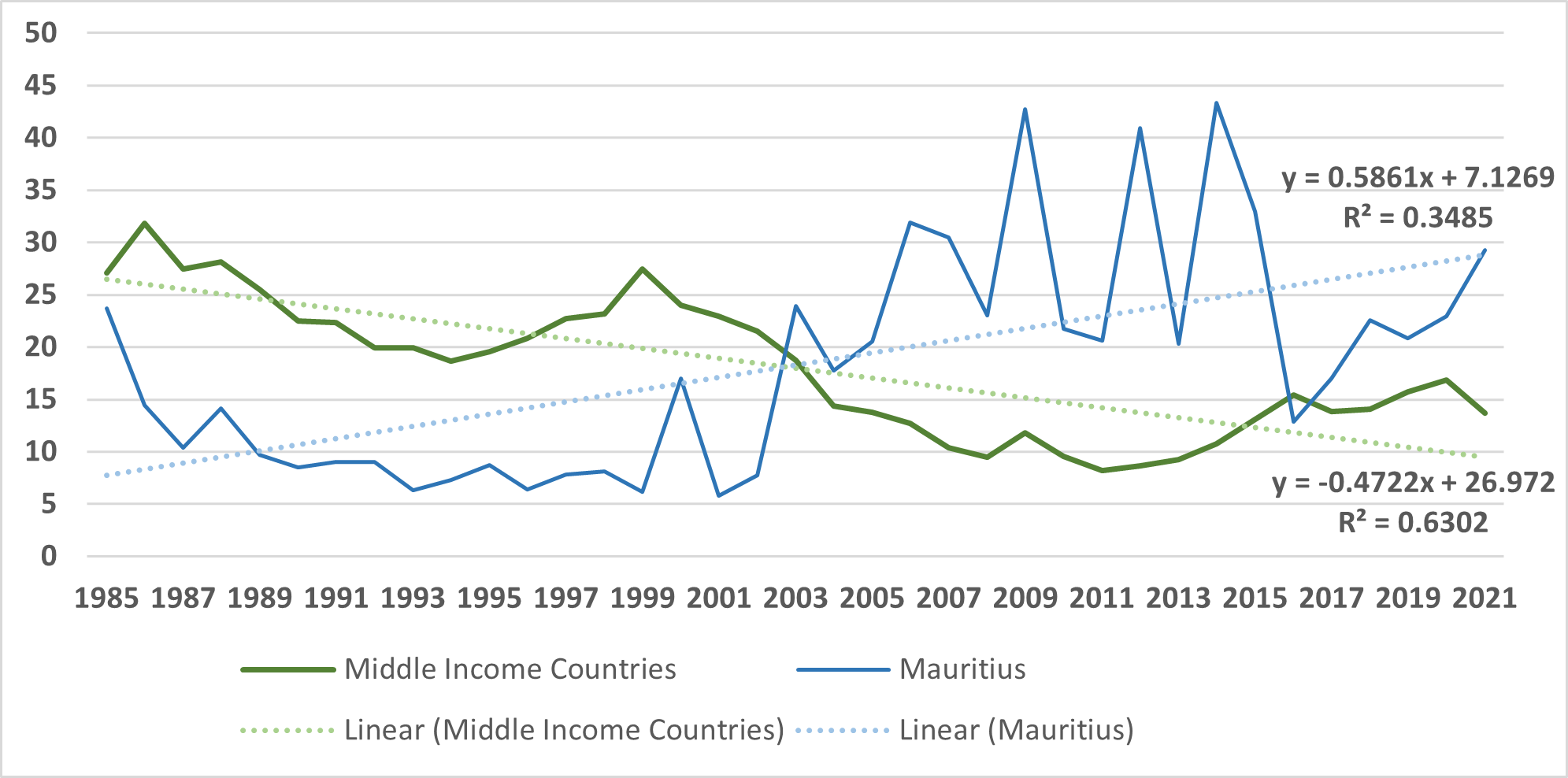

The government has been financing its debt in part by borrowing from abroad (denominated in foreign currencies), leading to a net outflow of foreign currency and contributing to the current account deficit. Additionally, with higher debt comes higher debt servicing costs, with the country’s high level of external debt leading to a significant demand for foreign currency to repay debt, further contributing to the current account deficit. Debt servicing refers to the payments made by a borrower to a lender, which includes interest (which has recently increased significantly) and principal repayments. When debt servicing levels are high, it becomes difficult for a country to manage its financial obligations and finance its development. It is noteworthy that the debt service payments in Mauritius have now significantly increased (as a percentage of export revenues) while those of its peers are decreasing (see Figure 2).

Figure 2: Debt Service in Mauritius and Middle-Income Countries

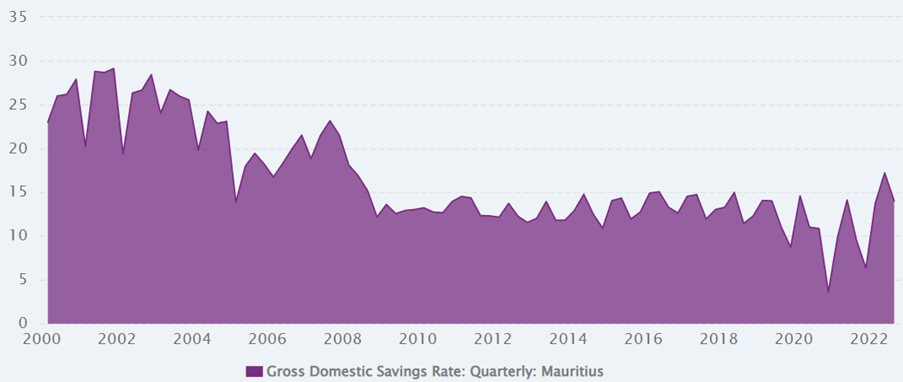

Historically, countries with greater savings rates have had quicker economic development than countries with lower savings rates. Capital accumulation increases a country’s output and productivity by offering an extra income stream for nations like Mauritius. However, Mauritius has witnessed a decline in the savings rate since 2000, which has resulted in an investment gap that negatively impacts the country’s current account (see Figure 3). The current account deficit reflecting the gap between national savings and investment (both public and private) might suggest either a low level of national savings relative to investment or a high pace of investment—or both. The gross savings rate in Mauritius [2] stood at 13.4% in September 2022, which was the same as the previous quarter. In comparison, the savings rate peaked in the early 2000s, reaching as high as 29%. Savings rate in Mauritius remained well above 15% until 2009; however, following the financial crisis of 2008-09 savings have continued to fall. The country’s high level of household debt, as well as the low interest rates in Mauritius, are one of the main reasons for this. Over the last decade, the external imbalance has been driven by a decline in national savings, including private savings [3].

Figure 3: Gross domestic savings rate since 2020

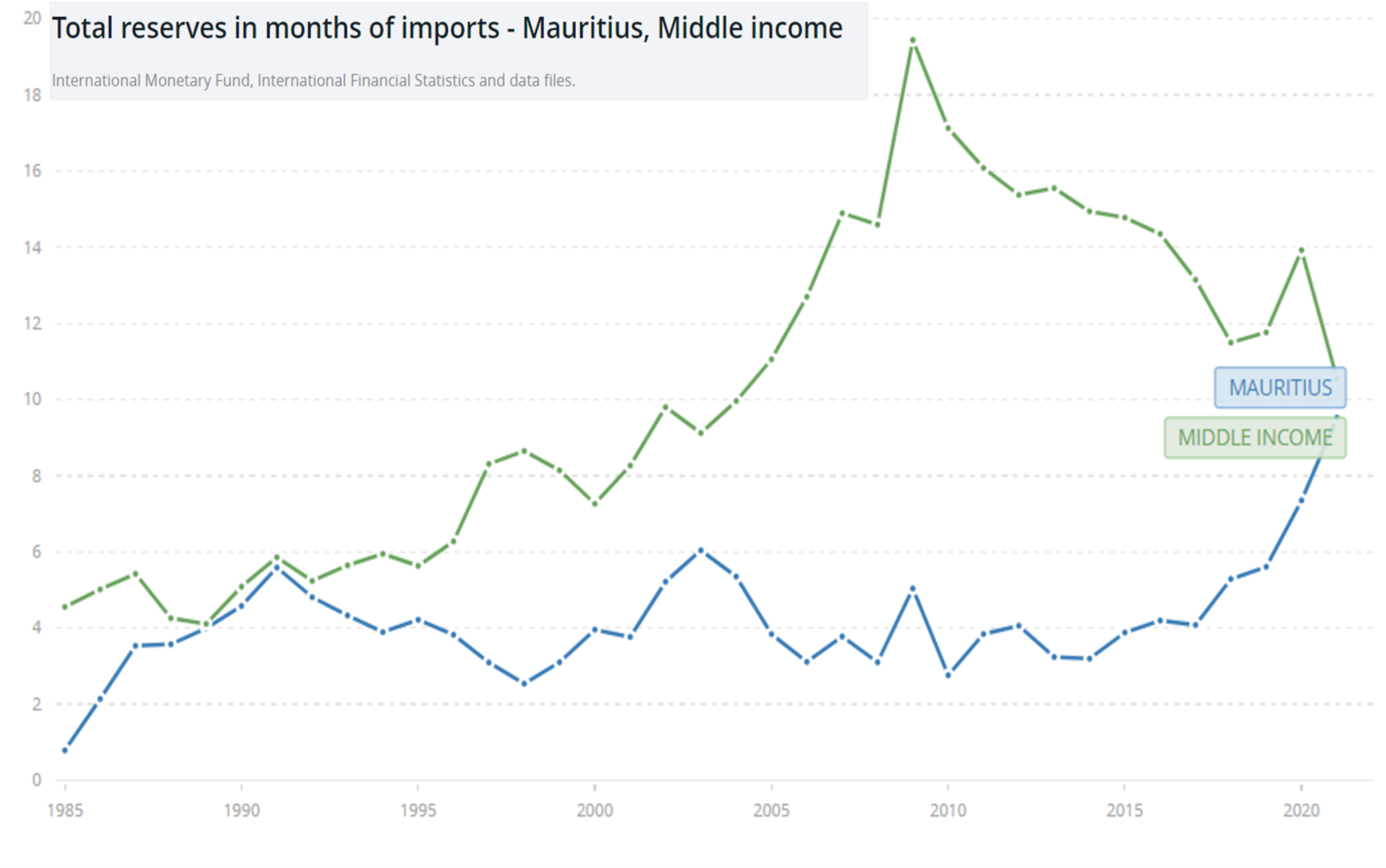

Despite the persistent current account deficits, foreign currency reserves remain significant, and Mauritius is in no immediate danger of a crisis. However, the current trajectory looks increasingly unsustainable in the long term. Nevertheless, Mauritius had enough reserves to cover around fourteen months of imports in 2022, down from a peak of nineteen months in 2009. While it historically always enjoyed a much better performance than its peers, in 2021, it was on par with other Middle-Income countries (Figure 4). As per CEIC data, Mauritius’ foreign exchange reserves stood at USD 5.7 billion in January 2023, representing a decrease from the previous month’s reserves of USD 6.7 billion.

Figure 4: Reserves of Mauritius and Middle-Income countries

Sustainability and Risk

A major concern with the persistent current account imbalances and drawing down on reserves is the fact that portfolio investments and FDI are highly volatile, even erratic. Figure 5 highlights the swings on a yearly basis in these flows, exacerbated by the fact that the great majority of investments are merely passing through Mauritius, rather than being invested in Mauritius.

Figure 5: Mauritius Current Account, FDI and Portfolio net flows

Over the past decade, Mauritius benefitted from portfolio flows which transited through Mauritian banks for onward investments into India on the back of the previous Double Tax Avoidance Agreement (DTAA) signed in 1982, which boosted incomes in the financial sector. The situation changed with the termination of the India-Mauritius DTAA, amended and in force since 2016. Several disruptions followed, starting with the Grey-listing of the Mauritian jurisdiction by the EU in 2020 and the continued disinvestment of foreign investors on the Stock Exchange of Mauritius since the initial Covid lockdown.

Although Mauritius has been since removed from the Grey list (announced by the FATF in October 2021), the outflow of currency resulting from share disinvestments, as well as pressure of governance parameters in the Global Business and International banking sectors, has not allowed Mauritius to mitigate the downturn in terms of tourism receipts. These combined effects have increased pressure on foreign exchange inflows, negatively impacting the current account.

Mauritius’ current account deficit is a complex issue influenced by several factors, including high imports, high debt, and low savings. The structural characteristics of the current account deficit have significant implications for the economy, including a deteriorating net investment position with the rest of the world, pressure on currency realignment, and a reduced outlook for economic growth. To address the current account deficit, the country must focus on improving its competitiveness in international trade, reducing its reliance on foreign borrowing, and increasing its levels of national savings.

Mauritius managed to maintain its international competitiveness on the back of a number of trade preferences. Both traditional export sectors, namely Sugar and Textiles, benefitted massively from protective and preferential trade regimes (initially from the EU Lomé Conventions and the WTO Multi-Fibre Agreement, then the EU Cotonou Agreement, then EPA, and US AGOA agreement). The challenge today is different – Mauritius faces increasing competition from third markets. It must show resilience as an exporter of goods and services, mainly on the back of improved productivity levels (both labour and capital). The Africa Continental Free Trade Agreement (AfCFTA) might, in the future, compensate to some extent for any losses in preferential margins.

A country will finance its deficit through borrowing (or investments) from abroad. Foreign Direct Investment (FDI) is a crucial determinant in most countries for economic growth and job creation. In Mauritius, the distribution of FDI across various sectors has been of concern because most investments in the last decade were not directed towards productive sectors. The largest share of FDI has been in real estate, which absorbed over 50% of flows in 2021 – with finite resources and no build-up of business capacities. This negatively impacts the country’s outlook for economic growth and competitiveness. The government should focus on creating a favourable investment climate in the manufacturing and service sectors to attract foreign investment. This will help create jobs, encourage skills transfer, increase exports, and improve the country’s competitiveness in the global market. Moreover, the government, as well as financial institutions, should also provide continued support and expertise to small and medium-sized enterprises in these sectors, as they are crucial for job creation and economic growth [4].

The debate around increased international competitiveness and higher savings rates can only happen if there is a structural shift underpinned by a strong framework driven by both the government and private entrepreneurs equally. The fiscal consolidation approach for the government must be carefully adjusted in order to reconcile pandemic recovery with long-term fiscal and debt sustainability. Adherence to fiscal rules is crucial in the medium term to maintain fiscal sustainability and decrease debt vulnerabilities, particularly given that the national debt has risen as a result of the Covid epidemic. If the economy continues to improve, revenues should rise thereby creating more fiscal space for government expenditure, which together with a targeted pension reform, will put debt on a downward trend in the medium term.

Policy areas for consideration:

- Fiscal consolidation is anticipated to be hampered in the short term by double-digit inflation and in the long term by the rising weight of pensions and the country’s limited tax mobilisation capabilities. The need to implement a comprehensive fiscal consolidation strategy to restore budgetary flexibility and sustain public debt is crucial.

- Targeted transfers to vulnerable groups may be done in order to sustain the food and oil crisis as well as the increasing import bill.

- Pursue structural transformation that promotes diversification and competitiveness in order to put Mauritius on the path to a sustainable and resilient economy powered by knowledge and technology.

- The new monetary policy framework of the Central Bank of Mauritius should be fully implemented such that it establishes the required capabilities and institutional structures to track a medium-term inflation target, thereby increasing policy credibility and resilience to shocks.

- Focus on increasing public awareness of the importance of savings, thereby encouraging private savings.

[1] The current account balance is a record of transactions between one country and the rest of the world for trade in goods, trade in services, investment income and government and private transfers.

[2] The primary goal of the Mauritius’ Special Purpose Fund from 2021 was to provide promoters and investors with a tax-exempt vehicle. However, it failed to pique the interest of investors due to the 2013 Rules’ restrictive provisions, which require an SPF to: invest only in nations that do not have a tax agreement with Mauritius; or invest primarily in assets whose returns are tax-free.

[3] IMF (2019). Staff Report for the 2019 Article IV Consultation: Mauritius. IMF Country Report No. 19/108. April.

[4] According to the Bank of Mauritius, in 2020, SMEs in Mauritius contributed to 44% of the total employment, 35% of the total domestic Gross Value Added (GVA) and 10.3% to the country’s total domestic exports. Statistics on the SMEs in Mauritius can be found here.

Main Photo by Ibrahim Boran on Unsplash.

Charles Telfair Centre is an independent nonpartisan not for profit organisation and does not take specific positions. All views, positions, and conclusions expressed in our publications are solely those of the author(s).