Paul R Baker, Founder and Chairman, International Economics Consulting Ltd (IEC)

Taahirah Zahraa Boodhoo Beeharry, Policy Researcher, International Economics Consulting Ltd (IEC)

In the wake of the COVID-19 pandemic, informal workers and businesses in Mauritius were severely impacted. The COVID-19 pandemic further augmented the vulnerabilities that workers in the informal sector face. The informal sector comprises a diverse range of occupations, including subsistence farmers, domestic workers, industrial outworkers, and petty traders, among many others. During past economic and financial crises, the informal sector usually offered temporary relief to workers who lost their jobs within the formal sector, acting as a “buffer” that absorbs segments of the unemployed workforce.

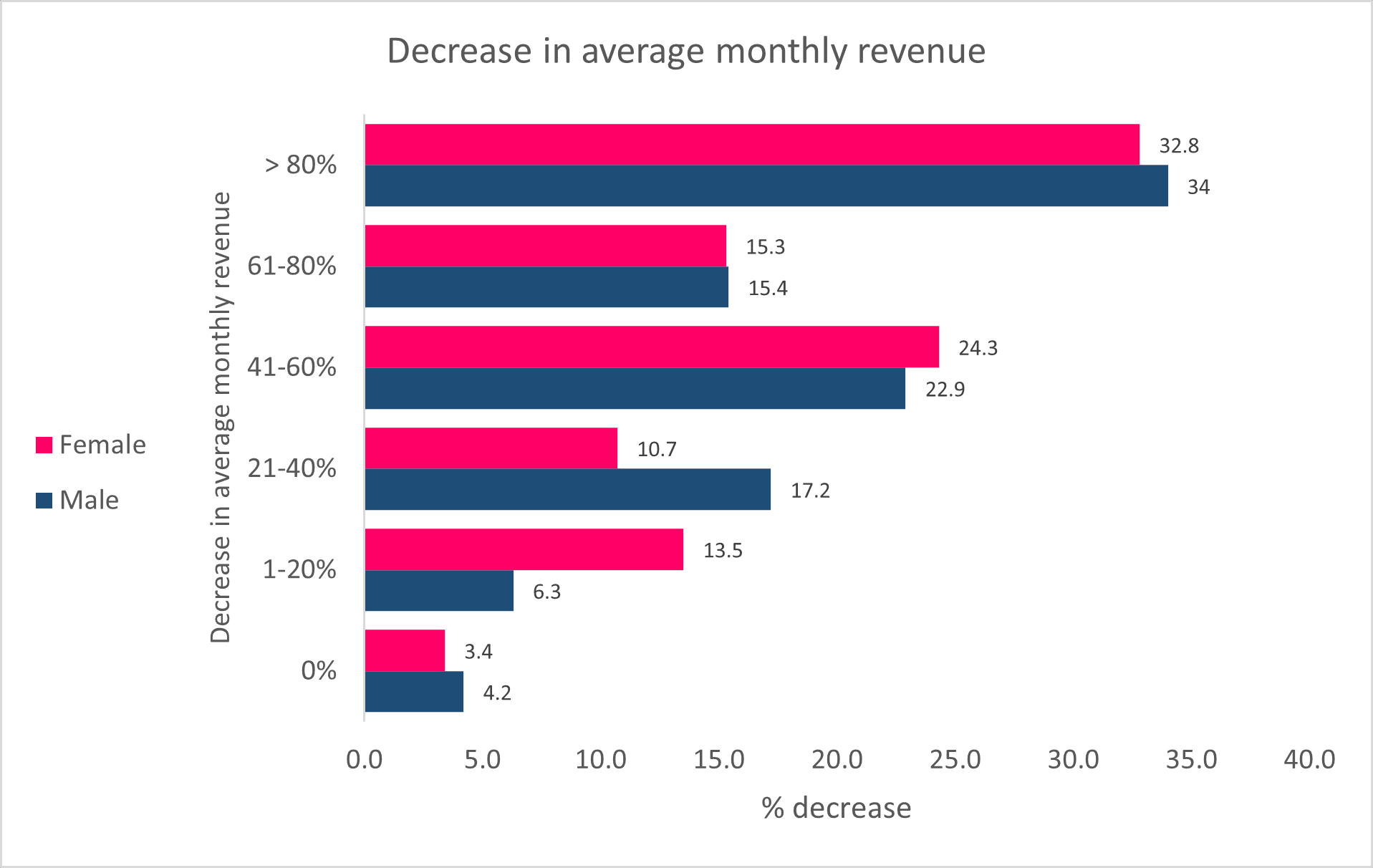

However, with the prolonged lockdowns and the interruption of economic activity caused by COVID-19, both workers in the formal and informal sectors were cut off from their workplaces and many were left vulnerable and without the means to earn a living. As per the results of a survey conducted by International Economics Consulting Ltd. (IEC) in the context of a forthcoming publication from the UNDP [1], it was found that the revenue of nearly half of the respondents operating in the informal sector declined by more than 60 per cent during the pandemic.

Despite women making up a smaller share of Mauritius’s overall informal workforce, the majority, 53.5 per cent, were employed in the informal sector in 2022 and they tend to be the more severely impacted by crises, including the pandemic. The COVID-19 pandemic compounded the vulnerabilities that women face within the economy in the sense that they are more likely to earn lower salaries, face greater job insecurity and have fewer opportunities to improve productivity and access training and finance. Mauritius ranked 105th out of 146 economies in the Global Gender Gap Report 2022, with an even worse ranking of 111th globally with regard to economic participation and opportunity. Moreover, when assessing the drivers of the informal sector, it is found that women face a range of additional hurdles preventing them from gaining formal employment or formalising their businesses.

Access to Finance Gap

One of the principal issues facing many informal women entrepreneurs relates to the accessibility of finance and credit. When it comes to financial inclusion, Mauritius performs better that its Sub-Saharan African peers, with only a 6 per cent gap in account ownership between men and women. However, generally, women-led enterprises face additional difficulties in obtaining access to credit than men. There is widespread evidence on the gap that women led Micro, Small and Medium Enterprises (MSMEs) encounter when accessing finance, highlighting that women are either underserved or unserved. For example, the World Economic Forum (WEF) highlights that about 4 out of 5 women-led enterprises are not adequately served by the current financial system, creating a global financing gap of USD 1.7 trillion.

During the pandemic, informal businesses encountered several issues in accessing credit facilities, loans, or other forms of financial support. Generally, most forms of formal financial support in Mauritius are solely provided to formal and registered businesses. The Development Bank of Mauritius (DBM) registered 14,802 requests for loans from 1 July 2020 up to 21 January 2022 [1]. Around one-third of these requests were not approved primarily because the businesses were not registered. Amongst the 313 respondents interviewed in our survey, 88 per cent indicated that they did not apply for financial support despite the challenges encountered during that period. Around 44 per cent of women-owned businesses that sought financial assistance were unsuccessful in obtaining any form of assistance.

In addition, women also encounter other challenges such as higher collateral requirements or additional documentary procedures that further hinder their access to finance, despite them having equal rights to access financial services. While many commercial banks in Mauritius have implemented microfinance initiatives, collateral security is required for most schemes, restricting women’s ability to make the most of these schemes[1].

The Global Partnership for Financial Inclusion advocates for the use of alternative data to assess creditworthiness. In this way, crowdlending platforms, such as Fundkiss Technologies Ltd. and FinClub, represent an important alternative for small businesses and especially women. Such platforms offer microfinancing and working capital loans without requiring any security. The eligibility for loans is instead assessed on the ability to repay the loan. Some platforms may also use personal bank statements as opposed to business statements to this end.

Digital platforms can support women-led business

Digitalisation of finance can support women-led business in three ways, namely through:

- Easier access to finance

- Promotion of business growth

- Transition from informality to formal activities

Digital platforms and mobile money can also empower women in the informal sector, giving them greater control over their financial lives as well as an avenue to earn a living. While these benefits are true for all informal activities, such solutions are particularly relevant for women as they tend to be most involved in informal sector activities and face additional obstacles to enter the formal sector. Despite saving money on par with their male counterparts, a sizeable proportion of women globally save money through informal arrangements as opposed to formal financial services. In Senegal, the World Bank found that approximately 81 per cent of women’s savings were handled through informal arrangements, including merry-go-rounds, and saving clubs. These severely limit women’s access to loans and credit through formal institutions. By understanding the advantages of such arrangements, formal financial services can be better adapted to suit the needs of women. In fact, a study conducted in Zambia found that women predominantly used mobile money to store and save money. As such, through the uptake of mobile money and digital transactions, digital financial records can be used as a way of ascertaining creditworthiness, showing women-led businesses’ cash flow, enterprise performance or savings history. Such alternative approaches to determining risk can increase the accessibility and affordability of credit for women.

The COVID-19 pandemic accelerated digitalisation globally as well as in Mauritius. The Mauritius Commercial Bank Ltd. (MCB) witnessed a surge in the demand for digital banking, contactless payments, and mobile payments with its subscribers on the mobile platform, MCB Juice, reaching over 400,000 subscribers in August 2021, increasing by at least 60,000 new subscribers. Concomitant with the rise in digital banking, there has also been a significant increase in digital commerce activities and online purchases with many small businesses mushrooming on social media platforms such as Facebook, Instagram, WhatsApp and TikTok with women offering a range of services, including retail trade. In the survey conducted by IEC, 39% of informal women-led businesses indicated that the pandemic boosted the digitalisation of their operations [1]. It was also found that more than 3 out of 4 informal business owners use electronic devices such as mobile phones in conducting their businesses and over a third use social media platforms to market their products and services. Greater investment and assistance are, nonetheless, necessary, to further promote the uptake of digital solutions for businesses.

In Uganda, informal sector actors have also been able to partner with one of the largest e-commerce platforms in Africa, Jumia, to sell their products while in Ecuador, it was found that the emergence of gig platforms also facilitated the matching of informal workers to digital work, allowing many of them to formalise. However, given the diverse type of jobs that can be created by digitalisation, it is equally important to make sure that new opportunities provide security and stability regarding incomes and working conditions of informal workers and allow them to effectively transition to the formal sector.

Digital solutions are expected to play an instrumental role in financially empowering women in the informal sector to gain a stable source of income and improve their creditworthiness. Combined with the use of gender-sensitive indicators, mobile money can offer an important way of mitigating both the financing gap and the level of informality faced by women entrepreneurs by making it easier for financial institutions to assess the creditworthiness of women-led businesses. Digital data generated from transactions conducted online can provide an overview of the cash flow and performance of businesses, reducing the risk for formal institutions to lend money and thus decreasing the costs of credit for women as well.

Recommendations

Some suggested measures which could ease women’s transition to the formal economy include:

- Improving access to finance and enhancing the environment for the evolution of digital payments;

- Studying the impact and feasibility of the use of alternative data and the adoption of a gender-sensitive approach to financial borrowing; and

- Encouraging female digital literacy as well as business literacy throughout the education system and through lifelong learning opportunities

In designing a policy response to the challenges of informality and access to credit, there are some important considerations for Mauritius to address:

- How inclusive is the Mauritian financial sector, for example, how many women-owned businesses are currently underserved or unserved by commercial banks or other forms of formal financial institutions?

- What are some of the major obstacles hindering women’s access to credit and should the gender-neutral approach to borrowing be replaced by a more gender-sensitive approach?

- What are the main categories of alternative data available locally that can be utilised to assess creditworthiness, e.g., existing records of payment histories from retailers, government, and utility companies, among others?

- How can cashless modes of payment be made more accessible to a wider group of individuals, especially small business owners?

- How can the digital divide gap be eliminated and ensure that digital literacy training can facilitate the uptake of digital modes of payment and create new economic opportunities for vulnerable and marginalised groups in society?

[1] International Economics Consulting Ltd (IEC) (2022). A diagnostic study on the informal sector in Mauritius to facilitate post-COVID recovery. UNDP. Forthcoming

Main photo by RODNAE Productions on Pexels.

Charles Telfair Centre is an independent nonpartisan not for profit organisation and does not take specific positions. All views, positions, and conclusions expressed in our publications are solely those of the author(s).